Theory Ventures General Partner Tomasz Tunguz shares observations from a GTM survey Theory Ventures did with hundreds of startups, 68% of them early-stage, well-funded, mostly mid-market ACV, and 25% remote.

Here's what they found:

- AI today has no impact on conversion rate

- AI does not impact ARR growth, even though people who buy AI perceive it as meaningfully contributing to overall efficiency gains

- If you’re considering changing your pricing model, consider creating a hybrid or matrix pricing model (seat + usage). You’ll have six percentage points more of net dollar retention.

- Selling to mid-market is much harder now

5+1 Big ideas from the talk

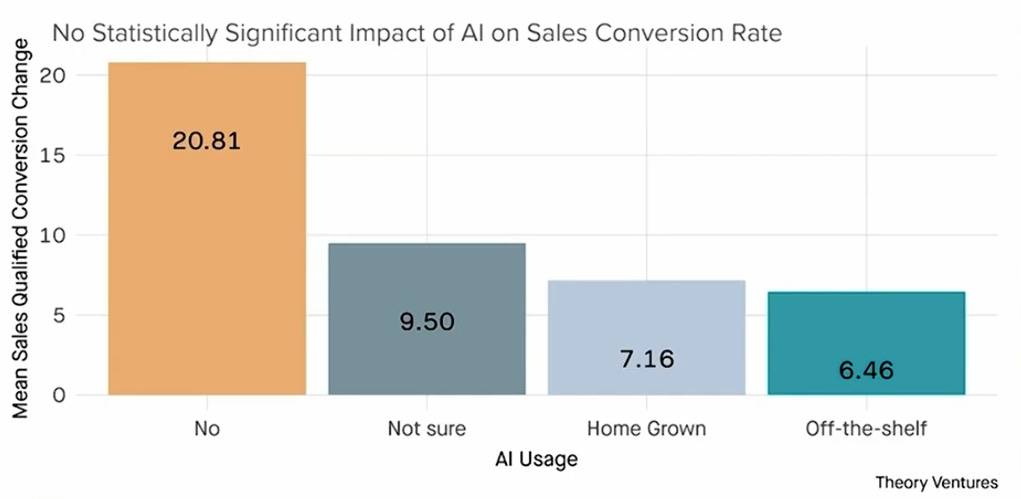

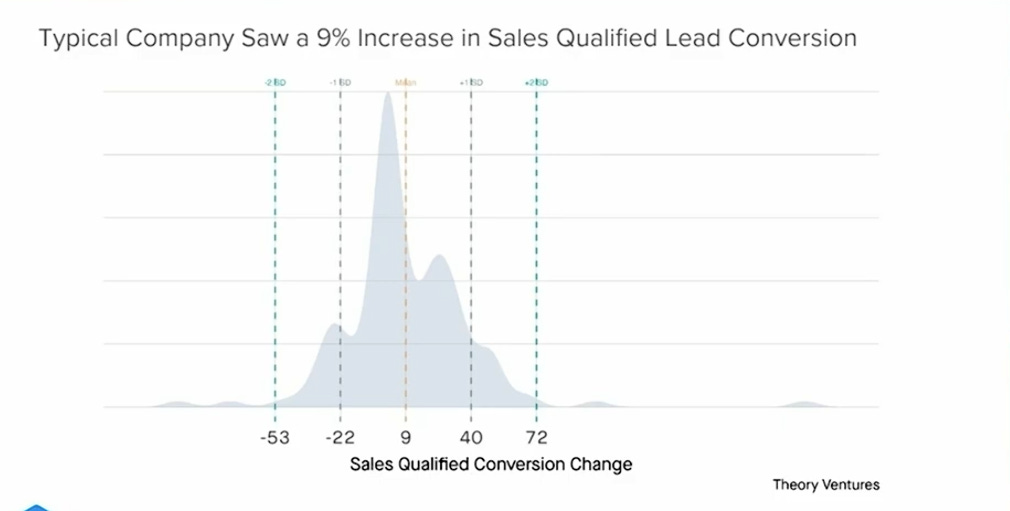

1. AI's Impact on Sales Conversion Rates: No Statistical Difference Yet

Despite the widespread adoption of AI tools in sales, current data indicates no significant difference in ultimate conversion rates between companies that use AI and those that don't. While AI is generating excitement and perceived efficiency gains, it has yet to demonstrably impact bottom-line sales performance.

"If we... ran the statistical test, there’s actually no difference in performance if you look at ultimate bookings of a company or their ultimate lead conversion rate irrespective of whether or not [they] use AI. It doesn't matter."

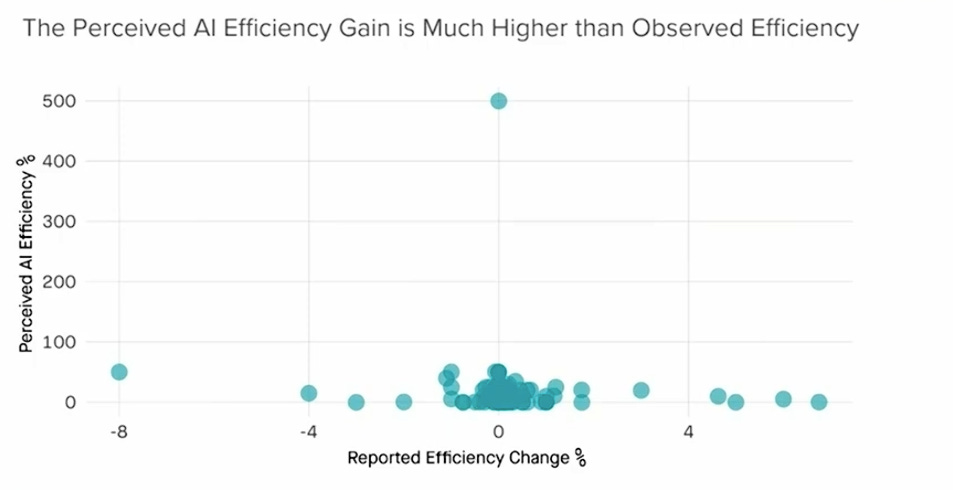

2. The Struggle to Demonstrate ROI on AI Investments

Buyers are increasingly questioning the return on investment (ROI) of AI solutions. This skepticism arises from the difficulty in quantifying the value generated by AI tools, particularly concerning their impact on sales outcomes.

Data Point: While many respondents believe AI is making their sales processes more efficient, this perception isn't reflected in the data measuring actual performance improvements.

3. Lengthening Sales Cycles and Their Impact

Sales cycles are experiencing a notable increase in length, primarily attributed to the shift to virtual selling and heightened buyer scrutiny due to economic pressures. Longer sales cycles create challenges for software companies, including pipeline supply shocks, decreased predictability, and negative effects on cash flow and sales team compensation.

Sales cycles have increased by an average of 12%, leading to a corresponding increase in payback periods.

4. The Rise of Hybrid Pricing Models

A significant trend in the software industry is the shift away from traditional seat-based pricing models towards hybrid models that incorporate usage-based components. This approach aligns with pricing theory and demonstrably leads to higher net dollar retention rates.

Companies using a combination pricing model (seats plus usage) experience 3x the growth in net dollar retentioncompared to those using other pricing models.

5. Adapting to a CFO-Driven Buying Environment

With economic uncertainty and pressure to reduce costs, Chief Financial Officers (CFOs) are exerting greater influence on software purchasing decisions. This shift necessitates software companies to adapt their sales strategies to address CFO concerns, emphasizing cost savings and clear ROI

.

The office of the CFO is now tightening the purse strings, eliminating discretionary budget…at the mid-manager level.

A call for exceptional use cases

He highlights the importance of moving beyond average AI applications in sales and seeking out the unique, exceptional, and outlier use cases that can unlock significant value. Finding this "shth" – the elements that differentiate a business – can provide a competitive advantage

The video.

https://youtu.be/SjM4gFA2AYY